Competition Appellate Tribunal Upholds Penalty on PVMA

The Competition Appellate Tribunal (CAT) has rejected the appeal submitted by the Pakistan Vanaspati Manufacturers Association (PVMA). This action reaffirms the Competition Commission of Pakistan’s (CCP) directive to impose a penalty of Rs50 million on PVMA for engaging in unfair competitive practices, according to an official statement released on Friday.

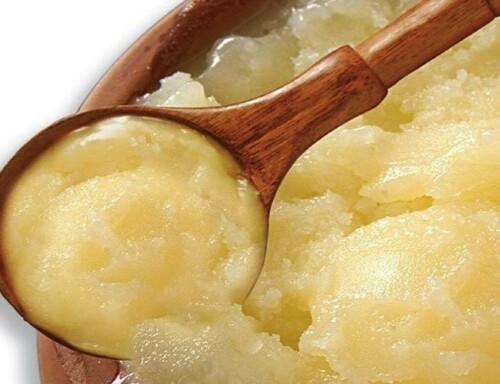

PVMA, which represents almost 100 ghee and cooking oil producers nationwide, contested the CCP’s ruling from 2011. The ruling stated that PVMA had contravened Sections 3 and 4 of the Competition Act, 2010.

The case was initiated following an investigation and a subsequent show-cause notice in April 2011, prompted by CCP’s observation of synchronized increases in edible oil prices.

The commission determined that PVMA leveraged its position to orchestrate price-fixing schemes by negotiating prices with governmental bodies and instructing its affiliates to adopt consistent pricing strategies.

Even though PVMA insisted these were merely recommendations, the commission determined that such directives were, in effect, enforced, thereby diminishing price competition.

The CCP also substantiated that PVMA had formed alliances with oil tanker associations and the National Logistics Cell (NLC) to establish fixed transportation tariffs.

According to the commission, these arrangements undermined equitable competition within the logistics sector and put non-member businesses at a disadvantage. In addition to collusive pricing and logistics agreements, PVMA was also found guilty of exploiting its influential status by implementing unjustifiable fees for the validation of import invoices—a task assigned to it by customs authorities to combat under-invoicing issues, the statement mentioned.

PVMA imposed a charge of Rs4 per metric ton for its members for the verification service, whereas commercial importers were charged Rs10 per metric ton without any clear rationale.

In its defense, PVMA asserted that its members remitted substantial membership fees and annual dues and that the commercial importers ultimately distributed their goods to PVMA’s member manufacturers.

PVMA also contended that it lacked the legal authority to enforce pricing arrangements and had only acted under governmental pressure to stabilize prices in response to the volatility of international palm oil rates. However, both the CCP and the Tribunal dismissed these justifications.

The tribunal noted that the customs authorities delegated the verification service to PVMA for all importers and that varying service fees between members and non-members was indefensible.

The order specified that such discriminatory charges could not be justified under the premise of objective justification, particularly since the costs were ultimately borne by PVMA’s members.

While the CAT affirmed the Rs50 million penalty imposed by the CCP, it amended the commission’s order by providing PVMA a 15-day period to rectify its discriminatory practices.

Should PVMA not comply within the allotted timeframe, an additional penalty of Rs1 million per day of non-compliance—initially included in CCP’s order—would be reinstated.

The tribunal underscored that even non-binding or advisory decisions made by associations could contravene competition law if they lead to a reduction in market competition.

Comments (0)

No comments yet. Be the first to comment!

Leave a Comment