Committee to Present Report on Tax Rationalization to SAPM

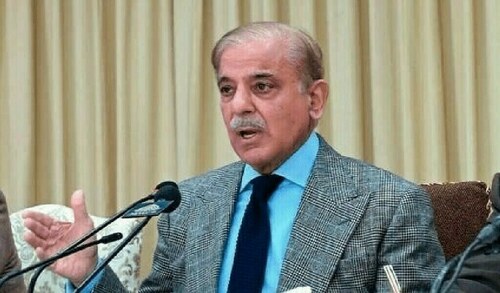

A special committee, formed by Prime Minister Shehbaz Sharif to streamline tax rates in collaboration with the business sector, reached a unanimous decision on Monday. The committee will submit an extensive report on the matter to the Special Assistant to the Prime Minister (SAPM) on Industries and Production, Haroon Akhtar Khan.

Under the guidance of Haroon Akhtar Khan, the prime minister-established committee convened to address concerns pertaining to the simplification of various taxes across the nation. In addition to the Additional Secretary of the Finance Ministry, high-ranking officials from the Federal Board of Revenue (FBR), State Bank of Pakistan, Commerce Ministry, and Board of Investment were present. Representatives from the Federation of Pakistan Chamber of Commerce and Industry, along with delegates from prominent chambers in the country, also participated.

The committee members engaged in a discussion regarding the difficulties arising from elevated tax rates and the absence of support measures for local industries. During the session, the SAPM emphasized that the prime minister established this committee to pinpoint challenges and propose practical solutions.

The SAPM underscored the necessity for Pakistan to tackle these pressing concerns to achieve economic competitiveness in the region. He noted that the industrial sector is severely impacted by substantial taxation, resulting in business closures.

“We must strive to revitalise struggling industries and expand the operations of existing ones,” stated Haroon Akhtar Khan. He conveyed that the committee’s suggestions and potential solutions would be presented to the prime minister for consideration in the upcoming budget. Haroon Akhtar Khan tasked the committee members with providing specific solutions and actionable proposals at the subsequent meeting.

During the assembly, the business community voiced their worries and recommendations concerning the prevailing business environment. They asserted that, to bolster the nation’s exports, the government must not only decrease input expenses, such as electricity and gas, but also lower the proportion of diverse taxes. Officials from the Ministry of Finance and the FBR informed the attendees that, given the country’s engagement with the International Monetary Fund’s program, tax reductions were not feasible. Therefore, “at this juncture, we must contemplate alternative options.”

Chairing another special committee established by the PM to address “undue interference by state authorities,” the SAPM on Industries and Production instructed the relevant departments to concentrate on resolving the difficulties encountered by industrialists and investors, as this is essential for the nation’s progress, rather than creating obstacles.

During the discourse, the business community voiced apprehensions regarding unwarranted interference by state institutions, the absence of Business Facilitation Centres and streamlined processes, and insufficient backing and tax-related challenges from the government.

Khan stressed that, in accordance with the prime minister’s vision, enabling industrialists would stimulate economic activities. He cautioned that unwarranted interference by state authorities could adversely impact investment and economic advancement.

Haroon Akhtar Khan emphasized that the prime minister anticipates state institutions to assume a pivotal role in delivering assistance, guaranteeing the safeguarding and support of industrialists, and enhancing business confidence.

He affirmed that the creation of Business Facilitation Centres, the promotion of ease of conducting business, and the formulation of supportive policies are indispensable avenues for the rejuvenation and expansion of Pakistan’s industrial sector.

Comments (0)

No comments yet. Be the first to comment!

Leave a Comment