Supreme Court Upholds Customs Duty on Specific Imported Items

The Supreme Court has rejected a petition that aimed to eliminate customs duties on imports falling under HS Codes 3402.1300 and 3402.1190.

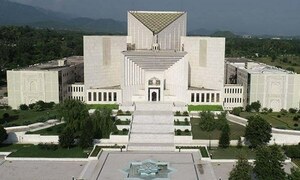

A three-member bench, led by Chief Justice Yahya Afridi, along with Justice Muhammad Shafi Siddiqui and Justice Shakeel Ahmad, resolved the matter concerning an appeal against a Sindh High Court (SHC) decision.

The petitioner, Surfactant Chemicals Company (Pvt) Limited, based in Karachi, sought an exemption from customs duties exceeding zero per cent as per SRO 565(I)/2006, dated June 5, 2006, and amended by SRO 474(I)/2016, dated June 24, 2016, for items imported under HS Codes 3402.1300 and 3402.1190.

Background of the Case

After the respondents, namely the Secretary of the Ministry of Finance and the Customs Department, denied the requested relief, the petitioner initiated constitutional petitions in the Sindh High Court. They asserted that the imported goods were completely covered by the exemption outlined in Column (3) of the Table at Serial (3) of the amending SRO.

The respondents argued that the petitioner was neither registered nor recognized by the Federal Ministry of National Food Security and Research, nor were they manufacturers of pesticides.

The petitioner countered that such registration or approval was unnecessary, as they do not manufacture agricultural pesticides themselves. They explained that they import, formulate, and manufacture agricultural surfactants/surface-active agents, such as stabilizers, emulsifiers, and solvents, which are utilized in pesticide manufacturing.

Court’s Observations

The court’s judgment highlighted that the SRO’s provision for zero per cent duty on such goods is not unconditional but is subject to specific terms within the SRO. The essential condition for zero per cent duty, as stated in Serial (3) of the Table in Column (2), requires approval from the Ministry of National Food Security and Research, a condition that the petitioner had not met.

The imported goods were classified under HS Codes 3402.1190 and 3402.1300 of the Pakistan Customs Tariff. The court stated that the HS Code alone is insufficient to grant zero per cent duty, and the necessary prerequisites must be fulfilled.

The judgment clarified that the SRO’s treatment of goods is contingent upon fulfilling certain obligations. The amended SRO mandated that the petitioner meet specific qualifications to be eligible for the exemption, which was exclusively available to manufacturers or formulators of agricultural pesticides recognized and approved by the Ministry of National Food Security and Research. Column (2) imposes a condition, stipulating that the customs duty exemption in Column (3) is contingent upon meeting the requirements in Column (2). The petitioner, however, is neither recognized nor approved by the Ministry of National Food Security and Research as a manufacturer or formulator of agricultural pesticides.

The Court further noted that the application of the order in Constitution Petition No.D-8496 of 2017 was appropriately distinguished, as it pertains to clause 133 of the Sixth Schedule to the Sales Tax Act, 1990, and is not analogous to the aforementioned SRO. The restriction present in the SRO is absent in clause 133 of the Sixth Schedule to the Sales Tax Act, 1990.

Comments (0)

No comments yet. Be the first to comment!

Leave a Comment