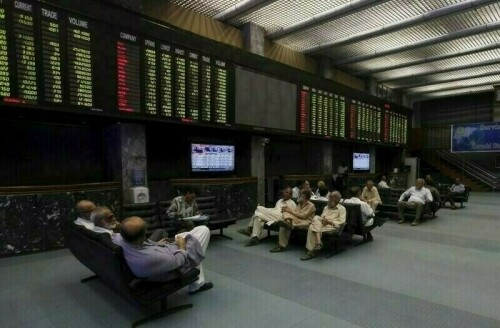

PSX Rallies Following Credit Rating Upgrade

The Pakistan Stock Exchange (PSX) commenced trading on a buoyant note today, buoyed by S&P Global’s decision to elevate Pakistan’s sovereign credit rating from ‘CCC+’ to ‘B—’. In the initial minutes of trading on Friday, the KSE-100 Index, a key market indicator, surged by nearly 700 points.

As of 10:05 am, the benchmark index stood at 139,352.72, reflecting an increase of 660.06 points, equivalent to a 0.48% rise.

Significant buying activity was evident across several key sectors, including automobile manufacturing, commercial banking, oil and gas exploration, oil marketing companies (OMCs), and power generation. Major stocks such as HUBCO, ARL, MARI, OGDC, PPL, and SNGPL all showed positive movement.

S&P Global’s upgrade of Pakistan’s sovereign credit rating to ‘B-’ with a ‘stable’ outlook, announced on Thursday, cited the stabilization of the country’s financial situation and reserves due to backing from the International Monetary Fund.

According to Arif Habib Limited, the S&P upgrade, following Fitch’s rating upgrade in April, is poised to bolster investor confidence, lower external borrowing expenses, and improve Pakistan’s prospects for re-entry into global bond markets.

Yesterday, the PSX experienced a downturn due to investor apprehension regarding macroeconomic challenges. Escalating inflation, combined with anticipations of a weaker rupee because of increased imports, exacerbated the prevailing negative sentiment.

The KSE-100 index decreased by 561.69 points, a 0.40% drop, closing at 138,692.67 points.

Meanwhile, across the globe, Asian stock markets receded from recent highs on Friday, as investors secured profits ahead of a critical week marked by the US President’s tariff deadline and a series of central bank meetings.

The dollar strengthened against the yen, recovering from a two-week low, supported by encouraging US economic data. Political uncertainties in Japan, fueled by media reports of Prime Minister Shigeru Ishiba’s potential resignation, weighed on the Japanese currency.

Benchmark Japanese government bond yields remained close to their highest levels since 2008.

Japan’s broad Topix index, after a surge of over 5% in the prior two sessions to reach an all-time high, declined by 0.7%.

The Nikkei index also experienced a 0.5% decrease from Thursday’s one-year high.

Hong Kong’s Hang Seng index fell by 0.5%, while mainland Chinese blue chips saw a 0.2% decrease. Australia’s equity benchmark also edged down by 0.5%.

Concurrently, US S&P 500 futures increased by 0.2%, following a slight rise in the cash index to a new record closing high overnight, driven by strong earnings from Alphabet, Google’s parent company.

The tech-heavy Nasdaq also reached a record high.

MSCI’s global stock gauge decreased by 0.1%, remaining just below its all-time peak from Thursday.

This information reflects an intra-day update.

Comments (0)

No comments yet. Be the first to comment!

Leave a Comment