Economic Survey 2024-25: Inflation Drops, GDP Growth Falls Short

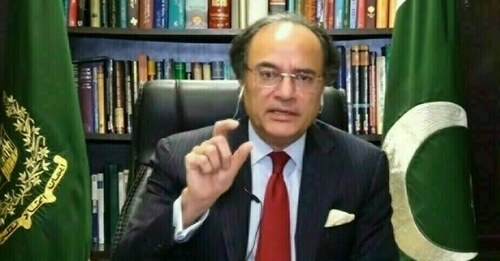

Finance Minister Muhammad Aurangzeb announced on Monday that inflation has decreased significantly from 29% in fiscal year 2024 to 4.5% in fiscal year 2025. He attributed this progress to improvements in the fiscal, monetary, and governance sectors, indicating that the nation is heading in a positive direction.

The minister made these remarks during the unveiling of the Economic Survey 2024-25. The survey revealed that the country did not achieve its GDP growth target of 3.5% for fiscal year 2025, with actual growth reaching 2.68%.

Accompanied by Finance Secretary Imdadullah Bosal and Chief Economist Dr. Imtiaz Ahmed, the minister asserted that economic indicators have shown betterment under the leadership of Prime Minister Shehbaz Sharif. He emphasized that the increase in GDP signals promising economic advancement.

Aurangzeb noted that global GDP growth was 3.5% in 2023, which then fell to 3.3% in 2024, and is projected to be 2.8% based on current forecasts. Pakistan’s growth rate was -0.2% in 2023 and 2.5% in 2024. “While there’s a general slowdown in global GDP growth, Pakistan’s performance must be considered within this broader global context,” he stated.

The GDP experienced a 2.68% expansion, primarily driven by a 4.8% surge in industrial activities. The economy’s magnitude reached $411 billion for the first time, and the per capita income rose to $1,824, he added.

Sector-Specific Performance

- Industry grew by 4.8%.

- Small-scale manufacturing expanded by 1.3%, while large-scale manufacturing saw some contraction, albeit less than the previous year.

- The auto sector grew by 40%, wearing apparel by 8%, textiles by 2%, and petroleum products by 4.5%.

- Services sector showed an expansion of 2.9%, with Information and Communication at 6.5%, Construction & Real Estate at 3.8%, and Food Services at 4.1%.

- The agriculture sector grew by 0.6%, with livestock up by 4.7% and poultry performing exceptionally well at 8%. Fisheries and forestry also showed growth. Fruits and vegetables collectively grew by 4.8%.

- Agricultural credit increased by 16%, surpassing two trillion rupees.

The finance minister reported a current account surplus of $1.9 billion for the first ten months of the fiscal year, projecting a year-end surplus. He added that the policy rate had decreased from 22% to 11%, and the debt-to-GDP ratio had improved from 68% to 65%. The economic recovery that began in 2024 has continued into 2025.

Responding to questions about the data, Aurangzeb affirmed the figures were official estimates provided by the government. He also highlighted the re-establishment of credibility and trust with the International Monetary Fund (IMF) under Prime Minister Shehbaz Sharif’s leadership.

He lauded the efforts of the caretaker finance minister, Dr. Shamshad Akhtar, for maintaining discipline during the transition. He outlined two key reasons for seeking a new arrangement with the IMF: achieving lasting macroeconomic stability and implementing essential structural reforms to fundamentally transform the economy.

Aurangzeb noted that the tax-to-GDP ratio has reached a five-year high, driven by digital invoicing, production tracking, AI audits, and a faceless customs regime. Industrial and household energy tariffs have been reduced, and private sector involvement has been introduced for power distribution companies. Reducing distribution losses and resolving the Rs1.275 trillion circular debt are crucial.

The government plans to privatize 24 State-Owned Enterprises (SOEs) with renewed focus under the guidance of Mohammad Ali. Debt servicing, the largest expense for the federation, saw savings of Rs800 billion due to the decrease in the policy rate.

Pension reforms will include defined contributions for new government employees starting July 2024. Rightsizing efforts are underway, targeting 43 ministries and 400 attached departments, focusing on how to streamline the federal government.

Exports, especially in the IT sector, saw a 7% increase. Imports also increased by 12%, with non-oil imports nearing pre-economic crisis levels of 2022. Sectors experiencing decline, such as chemicals, iron, and steel, require deeper analysis.

Fitch upgraded Pakistan’s credit rating, and Moody’s outlook turned positive. Pakistan received the latest IMF tranche and climate financing, demonstrating international support. The Special Investment Facilitation Council (SIFC) is expected to be a catalyst for change, with Rs30 billion raised through Sukuk bonds.

Remittances have shown remarkable growth, increasing by 31% year-on-year to $31 billion, with a record $4.1 billion in March. Overall remittances are projected to reach $37-38 billion. Inflows from Roshan Digital Accounts (RDA) have surpassed $10 billion, with 814,000 accounts opened.

Revenue collection increased by 26%, following a 30% growth in the previous fiscal year. The number of individual filers doubled to 3.7 million, and high-value filers increased by 178%. There was a 74% increase in retail registrations in the last fiscal year.

The government has brought back Rs1 trillion in local debt by reducing prices and markup rates, signaling to the banking system that it is not a desperate borrower. Easier credit terms should bolster economic recovery. The fiscal deficit was 2.6% of GDP in the first three quarters, with inflation projected at 4.6% for the year.

The minister also commented on a recent World Bank report indicating that 44.7% of Pakistanis live below the poverty line. He emphasized the government’s role in creating an ecosystem that fosters employment opportunities, highlighting the potential of freelancers and initiatives like the $15 million grant to LUMS for blockchain technology.

He affirmed his commitment to enforcing the Rs37,000 minimum wage. In coming years, the need for external financing will decrease, and the country is on track to achieve a 4.2% growth target. The budget will include measures to support vulnerable groups. The Finance Secretary noted the significant reduction in the fiscal deficit through reduced expenses.

For fiscal year 2025, growth was impacted by a decrease in large-scale manufacturing output and declines in major crops. The agricultural sector experienced its lowest growth in nine years at 0.6%, due to adverse weather conditions.

The government’s total revenue for the first three quarters of fiscal 2025 was 13.37 trillion rupees, a 36.7% increase year-over-year. The central bank has cut its policy rate by over 1,000 basis points this fiscal year to encourage growth, bringing the key rate to 11% after a pause in March.

The update occurs as Pakistan’s economy is stabilising, but remains fragile as the country undergoes reforms under a $7 billion IMF program. Pakistan’s federal budget for the next fiscal year starting July will be released on Tuesday.

Comments (0)

No comments yet. Be the first to comment!

Leave a Comment