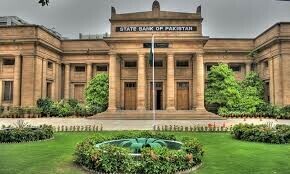

Central Bank of Pakistan Anticipated to Lower Interest Rate

A recent poll suggests that Pakistan’s central bank is likely to decrease its benchmark interest rate by 50 basis points to 10.5% this Wednesday. The consensus among analysts points towards further monetary easing, driven by decelerating inflation and improvements in the country’s external financial position.

The survey, encompassing 14 analysts, indicates a unanimous expectation of rate cuts by the State Bank of Pakistan (SBP). Specifically, nine analysts predict a 50 bp reduction, which also represents the median forecast. Four analysts foresee a more substantial 100 bp cut, while one anticipates a smaller 25 bp decrease.

Pakistan’s consumer price inflation was recorded at 3.2% in June. The average inflation rate for the fiscal year concluding on June 30 has significantly dropped to 4.49%, a nine-year low, compared to the previous year’s 23.4%.

Given the positive real interest rates, most analysts foresee continued easing, supported by stabilizing economic indicators and elevated government borrowing expenses.

Sana Tawfik, who is the Head of Research at Arif Habib Limited, stated that the SBP has the potential for reduction due to moderating inflation and better external accounts. However, she cautioned that rising imports and exchange rate pressures necessitate a careful, data-reliant strategy.

Pakistan’s reserves have increased to over $14 billion, backed by inflows from the International Monetary Fund (IMF) under a $7 billion program and bilateral funding.

The finance ministry projects inflation for July to be between 3.5% and 4.5%, highlighting an anticipated easing of price pressures.

Recent pressures on the rupee have led to increased measures against informal dollar trading, reflecting the government’s focus on stabilizing the exchange rate as the central bank evaluates further monetary easing.

The SBP initiated rate cuts from a peak of 22% in June 2024, implementing 10 percentage points of easing before pausing in March. Subsequently, a further 100 bps cut was implemented in May, but rates were held steady in June due to escalating tensions between Iran and Israel.

Earlier in the month, SBP Governor Jameel Ahmad stated at the Reuters NEXT Asia summit that the central bank would adopt a ‘tight’ policy to ensure inflation remains within the 5-7% target range, noting that the current policy is impacting both inflation and external accounts.

Ahmed Mobeen, a senior economist at S&P Global Market Intelligence, suggested that while the SBP is expected to lower rates further, it might proceed more cautiously in the latter part of the year, influenced by increasing import demand and global commodity market uncertainties.

Mustafa Pasha, the Chief Investment Officer at Lakson Investments, indicated that the central bank has the potential to gradually reduce rates to the high single digits by the initial months of 2026, driven by stronger buffers and the completion of the budget and IMF review.

S&P Global recently upgraded Pakistan’s rating to ‘B-‘ from ‘CCC+’, attributing the improved outlook to decreased inflation, fiscal consolidation, and enhanced reserve levels.

Comments (0)

No comments yet. Be the first to comment!

Leave a Comment