PSX Soars as Investor Confidence Boosted by Ceasefire

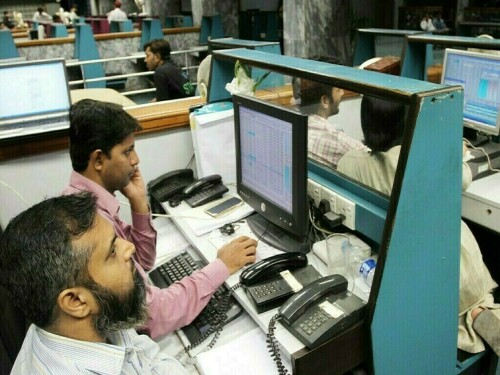

The Pakistan Stock Exchange (PSX) experienced a surge in positive activity as investors responded favorably to the ceasefire agreement between India and Pakistan. The KSE-100 Index concluded trading on Tuesday with an increase of almost 1,300 points.

The stock market commenced trading with significant upward momentum, as the KSE-100 Index rose by nearly 2,800 points, reaching an intra-day peak of 120,067.12.

However, according to market analysts, this surge was temporary, as investors engaged in profit-taking.

Buying activity resumed in the closing hours of the trading session, bringing the benchmark index to a final value of 118,575.88, representing a gain of 1,278.15 points, or 1.09%.

In a noteworthy development, Finance Minister Muhammad Aurangzeb stated in a Monday interview that the federal budget for the upcoming fiscal year, which begins in July, will be finalized within three to four weeks. He also mentioned scheduled budget discussions with the IMF from May 14-23.

The stock market demonstrated resilience on Monday, driven by a combination of encouraging factors, including the India-Pakistan ceasefire and the IMF’s approval of essential funding.

The KSE-100 Index increased by 10,123 points, marking its largest-ever gain, to close at 117,297.73.

Meanwhile, Indian benchmark indexes started lower on Tuesday after achieving their best day in over four years, following a fragile ceasefire agreement with Pakistan.

As of 9:25 am IST, the Nifty 50 had decreased by 0.52% to 24,784.95, and the BSE Sensex had fallen by 0.64% to 81,900.2.

At the opening, eight of the thirteen major sectors experienced losses. However, broader small-cap and mid-cap stocks traded approximately 0.2% higher each.

On Monday, the Nifty 50 and Sensex surged by almost 4% in a broad relief rally after India and Pakistan established and maintained a ceasefire following days of conflict.

Analysts suggest that the benchmarks are likely to consolidate following Monday’s rally.

Global investor sentiment is positive following an agreement between the U.S. and China to reduce reciprocal tariffs temporarily and collaborate to prevent disruptions to the global economy.

The MSCI’s Asia ex Japan index increased by 0.3% on Monday, building on a 2% rise in the previous session amidst trade optimism.

Comments (0)

No comments yet. Be the first to comment!

Leave a Comment