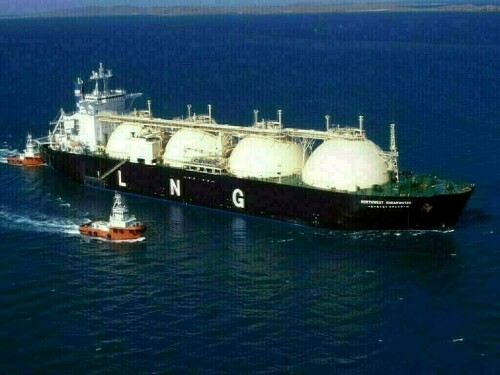

Asian LNG Prices Hover Near One-Year Low Amid Supply Issues

SINGAPORE: Spot prices for liquefied natural gas (LNG) in Asia have remained close to their lowest point in nearly a year this week. This stability comes as supply disruptions from three export facilities in the region and some purchasing activity offset the impact of generally weak demand.

Industry sources estimate that the average LNG price for delivery in June to Northeast Asia was $11.50 per million British thermal units (mmBtu). This represents a decrease from $11.80/mmBtu the previous week but remains at the lowest levels observed since mid-May.

According to Masanori Odaka, a senior analyst at Rystad, reduced Asian LNG prices prompted opportunistic purchases by certain East Asian importers. Supply disruptions at export projects in Australia and Brunei have also supported regional fundamentals, which would otherwise be declining. Odaka noted that Korea Gas Corporation, Taiwan’s CPC Corporation, and a Chinese importer have recently engaged in spot purchases.

He added, “While certain Asian importers utilized the price dip for acquisitions, others chose a cautious approach, assessing the volatile market conditions amidst adequate storage capacities.”

Inpex Corp, the operator of Australia’s Ichthys LNG, reported a temporary decrease in the plant’s production rate, without providing details on the cause or the expected resumption of full production.

Industry and trade sources in Southeast Asia indicated that Malaysia’s Bintulu LNG complex and the Brunei LNG plant are also encountering production challenges. Brunei LNG has reportedly cancelled a tender issued this month for a cargo scheduled for delivery in June.

Despite production halts in the Pacific region, the inter-basin arbitrage for prompt deliveries has remained closed. Martin Senior, head of LNG pricing at Argus, a commodities pricing agency, noted that only one carrier diverted in the mid-Atlantic towards Asia on April 16.

Senior stated, “Asian buyers have not since made a substantial effort to compete for Atlantic basin cargoes since the production outages.”

In Europe, S&P Global Commodity Insights assessed its daily North West Europe LNG Marker (NWM) price benchmark for cargoes delivered in June on an ex-ship (DES) basis at $11.124/mmBtu on April 16, marking a $0.735/mmBtu discount relative to the June gas price at the Dutch TTF hub.

Argus valued the price for June delivery at $11.29/mmBtu, while Spark Commodities assessed the May price at $10.945/mmBtu.

Senior commented that discounts to the TTF for May delivery are $0.20/mmBtu wider than those for June delivery. This is because regasification terminal maintenance in northwest Europe during May has compelled buyers to seek slots in more costly terminals or terminals delivering to hubs with lower prices than the TTF.

Spark Commodities analyst Qasim Afghan mentioned that the U.S. front month arbitrage to northeast Asia via the Cape of Good Hope now only marginally favors Europe.

Afghan also noted that Atlantic rates for LNG freight have decreased for the fourth consecutive week, reaching $21,750 per day on Thursday, while Pacific rates have declined to $23,250 per day.

Comments (0)

No comments yet. Be the first to comment!

Leave a Comment