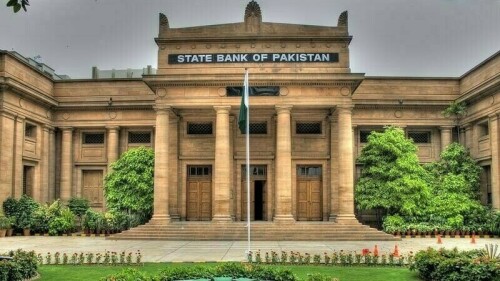

Special Committee Lauds SBP’s Efforts in Women Empowerment

ISLAMABAD: The Special Committee on Gender Mainstreaming has commended the State Bank of Pakistan (SBP) for its substantial initiatives in fostering women’s empowerment. These efforts are primarily channeled through the “Banking on Equality” Policy, which aims to narrow the gender disparity in financial inclusivity.

However, the committee has advised the SBP to simplify the processes for opening accounts and granting loans to women, particularly by removing collateral requirements.

The 7th meeting of the Special Committee on Gender Mainstreaming convened on Wednesday at Parliament House in Islamabad, presided over by Dr. Nafisa Shah, MNA.

Recognizing the State Bank’s proactive stance on women’s financial inclusion, the committee emphasized the need for tangible actions to integrate women into the formal economy. The committee noted that women often lack access to capital and are excluded from financial services due to the absence of collateral.

Members urged the State Bank to implement thorough and practical measures that ensure women can access the capital they require. They also called upon the government to provide political reinforcement for the State Bank’s “Banking on Equality” Policy.

The SBP deputy governor reported that banks have recruited over 13,116 women, increasing the proportion of female staff in financial institutions from 13% to 17%.

Additionally, he noted a surge of 14.4 million active accounts held by women. The number of women borrowers from microfinance banks has more than doubled, escalating from 912,000 to 2.6 million.

During a briefing on gender-based discrepancies in financial inclusion, the committee was informed that 64% of Pakistan’s adult population currently possesses a formal bank account. However, a gender divide exists, with 47% of adult women having at least one bank account, compared to 81% of men. This results in a 34% gender gap in financial inclusion. The SBP recently introduced the NFIS 2024-28, setting a target to raise financial inclusion to 75% and reduce the gender gap to 25% by 2028.

The committee suggested that the SBP should intervene to support women-led micro, small, and medium enterprises (MSMEs) through affordable financing and capacity-building programs.

The chairman of the Securities and Exchange Commission of Pakistan (SECP) delivered a detailed presentation on the SECP’s initiatives, highlighting the Prime Minister’s Women Empowerment Package 2024. He stated that the SECP has mandated all listed companies to disclose data on gender pay gaps in their annual reports. The committee further learned that the SECP is committed to boosting female representation in the workforce from approximately 28% to 40% by June 2030. It was also shared that the SECP now requires all medium and large-sized companies to appoint at least one female director to their boards, an initiative praised by the committee as a positive step toward women’s empowerment.

The meeting saw the participation of MNAs Aqeel Malik, Khawaja Izharul Hassan, and Munaza Hassan, along with Senators Rubina Qaim Khani, Saadia Abbasi, Fawzia Arshad, and Khalida Ateeb, as well as officials from relevant ministries and divisions.

Comments (0)

No comments yet. Be the first to comment!

Leave a Comment