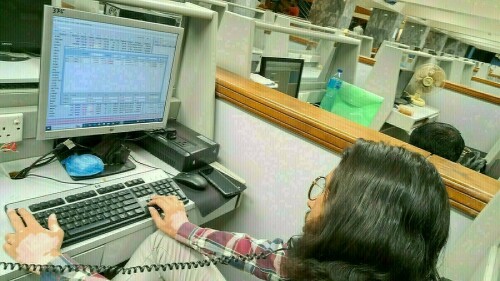

PSX Rallies as Central Bank Cuts Policy Rate

The Pakistan Stock Exchange (PSX) experienced a positive surge on Tuesday, buoyed by investor enthusiasm following the central bank’s decision to reduce the policy rate by 1%. The benchmark KSE-100 Index saw a rise of almost 700 points during the day’s trading.

As of 1:05pm, the KSE-100 Index stood at 114,787.14, reflecting an increase of 684.91 points, which translates to a 0.6% gain.

Buying activity was prominent across several key sectors, including automobile manufacturing, cement, commercial banking, oil and gas exploration, oil marketing companies (OMCs), power generation, and refineries. Major stocks such as HUBCO, NRL, PSO, MARI, OGDC, PPL, POL, MCB, UBL, and NBP all showed positive movement.

The State Bank of Pakistan’s (SBP) Monetary Policy Committee (MPC) opted to decrease the policy rate by 100 basis points (bps), setting it at 11% on Monday.

According to Mohammed Sohail, CEO of Topline Securities, “This reduction surpassed market forecasts.” Previously, market analysts had projected a smaller cut of 50bps.

On the preceding day, Monday, the KSE-100 Index concluded trading at a stable 114,102.24, recovering from an earlier decline of over 1,000 points during the session.

In related global market activity, international stocks maintained narrow trading ranges on Tuesday. The dollar recovered some ground against Asian currencies as investors refocused on worries regarding U.S. tariffs and their possible effects on economic expansion.

These concerns, along with pledges from major oil-producing nations to increase supply, have contributed to keeping crude oil prices near their lowest levels in four years.

Attention in Asia has turned to currency values after the Taiwan dollar’s significant gains, sparking discussions that regional foreign exchange rates might be adjusted to secure trade benefits from the U.S.

The Taiwan dollar’s upswing points to a considerable shift and highlights the situation in numerous economies where large trade surpluses have led to substantial long dollar positions among exporters and insurers, now under scrutiny.

Hong Kong experienced pressure on Tuesday, with its central bank intervening by purchasing $7.8 billion to prevent the local currency from appreciating and breaking its peg to the U.S. dollar.

In stock markets, MSCI’s broadest index of Asia-Pacific shares outside Japan declined by 0.2%, with Japanese markets closed for a holiday. Taiwan’s stock market experienced a 0.3% decrease.

Chinese markets reopened after a holiday, with the blue-chip index showing a slight increase at the start of trading. Hong Kong’s Hang Seng index decreased by 0.2%.

Investors are closely monitoring the possibility of reduced trade tensions between the U.S. and China following Beijing’s announcement last week that it was considering an invitation from Washington to discuss tariffs.

However, due to limited details, uncertainty persists, leaving investors to interpret information from the White House.

This information constitutes an intra-day market update.

Comments (0)

No comments yet. Be the first to comment!

Leave a Comment