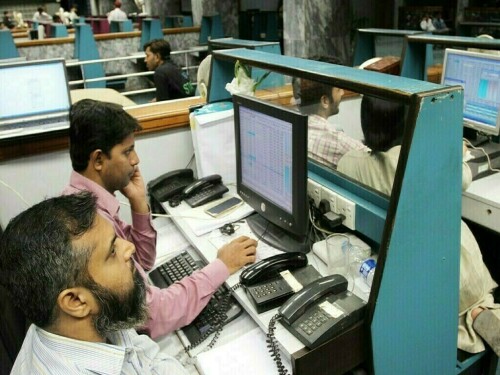

PSX Maintains Bullish Trend Amid Economic Developments

The Pakistan Stock Exchange (PSX) demonstrated strong upward momentum as investors responded positively to economic indicators, with the KSE-100 Index experiencing a surge of approximately 1,500 points during Tuesday’s trading session.

Trading commenced on an optimistic note, propelling the KSE-100 Index upward by almost 2,800 points, peaking at an intra-day high of 120,067.12.

Market analysts noted that profit-taking activities briefly tempered the upward surge. However, renewed buying interest emerged in the latter part of the trading day. By 2:50pm, the benchmark index was recorded at 118,794.86, reflecting an increase of 1,497.13 points, equivalent to 1.28%.

Key Fiscal Developments

Finance Minister Muhammad Aurangzeb stated in an interview that the budget for the upcoming fiscal year, which starts in July, is expected to be finalized within the next few weeks. Discussions with the IMF regarding the budget are slated for May 14-23.

Previous Day’s Market Performance

The stock market had previously exhibited a robust recovery, bolstered by a number of encouraging factors, including positive financial news and anticipated economic growth. The KSE-100 Index recorded a gain of 10,123 points, closing at 117,297.73.

Indian Market Overview

In contrast, Indian benchmark indexes started lower on Tuesday, following gains recorded in the previous session. At 9:25am IST, the Nifty 50 was down by 0.52% at 24,784.95 and the BSE Sensex decreased by 0.64% to 81,900.2. Most major sectors experienced losses at the opening, while small and mid-cap stocks showed slight gains.

On the preceding Monday, both the Nifty 50 and Sensex had climbed by nearly 4% due to broad market optimism.

Analysts predict a period of consolidation for the benchmarks after the previous session’s upswing.

Global Market Influences

Global investor sentiment remains positive due to international cooperation aimed at stabilizing the global economy. MSCI’s Asia ex Japan index showed a gain of 0.3% on Monday, following a 2% increase in the prior session, fueled by trade optimism.

This information reflects an update from intra-day trading activities.

Comments (0)

No comments yet. Be the first to comment!

Leave a Comment