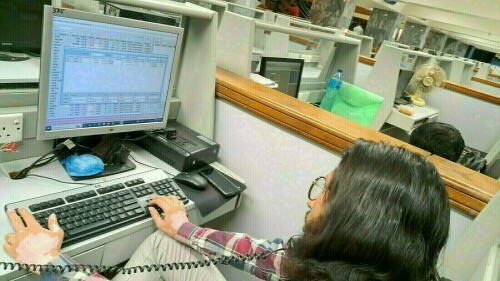

PSX Experiences Mixed Trading Day, Closes Lower

Following a record-breaking performance, the Pakistan Stock Exchange (PSX) underwent fluctuating trading patterns on Thursday. The KSE-100 Index displayed volatility, ultimately concluding the session with a decrease of approximately 160 points.

The trading day commenced with a dip, as the KSE-100 touched an intra-day low of 121,517.90. Subsequent buying activity propelled the index to an intra-day peak of 122,281.58.

However, the final trading hours saw a wave of selling, leading the benchmark index to close at 121,641. This represents a decline of 157.86 points, or 0.13%.

On Wednesday, the PSX maintained its positive trajectory for the second consecutive day, reaching a new all-time high. This surge was primarily attributed to favorable expectations surrounding the forthcoming budget.

The KSE-100 Index had risen by 1,348 points, or 1.12%, culminating in a record close of 121,799 points.

Global Market Overview

In the broader international context, Asian equities edged upward, while the US dollar remained subdued as investors awaited the European Central Bank’s (ECB) policy guidance amid global economic uncertainty.

The dollar weakened in the previous session due to disappointing US jobs and services data, with further employment figures expected on Friday. The impact of trade policies is increasingly evident, with bilateral agreements remaining elusive.

Canada considered potential retaliatory measures against the recently imposed US metals tariffs, while the European Union reported progress in trade negotiations with the United States.

Market observers anticipated a likely interest rate cut by the ECB, focusing on President Christine Lagarde’s indications regarding future policy directions.

Increased tariffs on steel and aluminium imports, enacted , affected Canada and Mexico, among others.

MSCI’s index of Asia-Pacific shares excluding Japan increased by 0.7% in early trading, whereas Japan’s Nikkei stock index decreased by 0.2%.

Comments (0)

No comments yet. Be the first to comment!

Leave a Comment