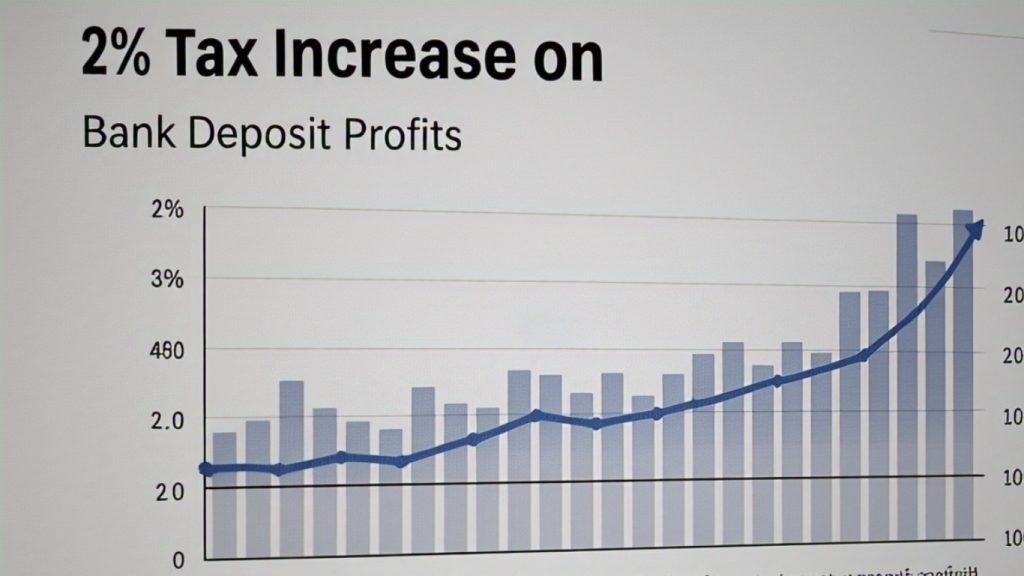

The Federal Board of Revenue (FBR) is considering a 2% increase in tax on profits from commercial bank deposits and national savings schemes in the upcoming Fiscal Year 2025‑26 budget. This increase would apply equally to both tax filers and non‑filers, raising rates for filers from 15% to 17% and for non‑filers from 35% to 37%.

The proposal is tied to IMF‑backed measures aimed at creating fiscal space to offer relief to salaried individuals without widening revenue shortfalls. However, final approval from the IMF is still pending, and detailed analysis has been requested.

Tax experts warn that this measure could put additional pressure on retirees and middle‑class savers who rely on interest income, especially in light of recent cuts to policy rates. A higher tax burden may also deter deposits, potentially affecting liquidity in the banking sector.

FBR officials argue that increasing tax on passive income streams like deposit profits offers a fair way to offset concessions elsewhere, while avoiding fresh taxes on active business sectors. As the Budget 2025‑26 deadline approaches, the government must balance economic relief with revenue targets to ensure fiscal sustainability.

Comments (0)

No comments yet. Be the first to comment!

Leave a Comment