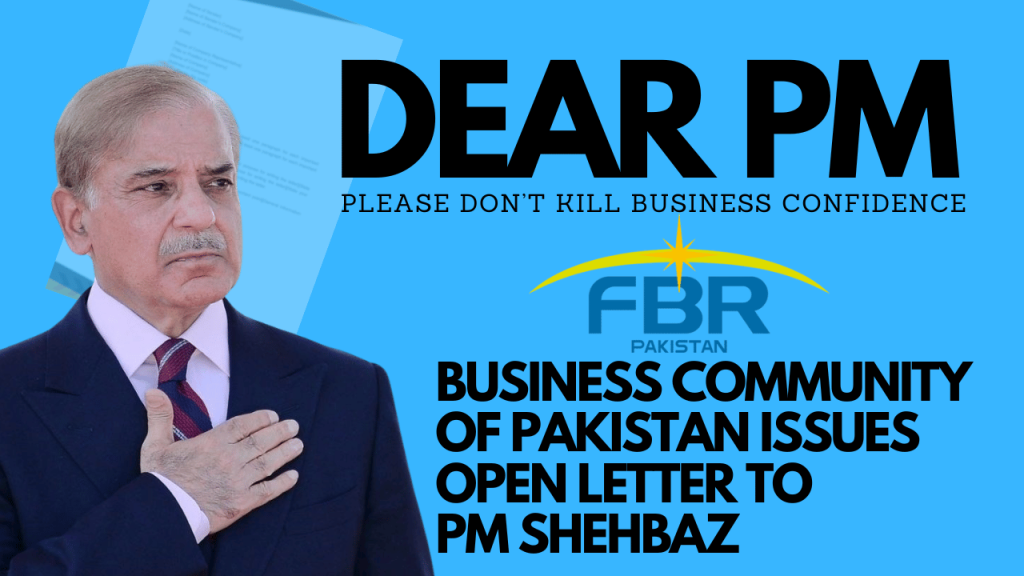

Request for Urgent Reconsideration: Repeal Unconstitutional Clauses from Finance Bill 2025

An Open Letter to the Prime Minister from Pakistan’s Business Community

The Right Honourable Prime Minister Muhammad Shehbaz Sharif,

We write to you with great urgency and a deep sense of concern. At a time when Pakistan stands at a fragile but hopeful turning point in its economic recovery, we appeal to your leadership to urgently intervene and repeal certain provisions introduced in the Finance Bill 2025. These provisions grant sweeping and unchecked powers to the Federal Board of Revenue (FBR) powers that, if passed into law, will not only violate constitutional protections but also severely damage investor confidence, undermine economic stability, and endanger legitimate business activity.

This is not merely a technical or legal objection it is a national economic emergency in the making. The Finance Bill 2025 includes clauses that allow the FBR to arrest business leaders without a warrant, seize assets without due process, and access confidential information from tax advisers. These are not just draconian but potentially unconstitutional powers that no democracy should ever allow to be misused under the pretext of tax enforcement.

It is in this alarming context that the formal business community of Pakistan comprising large-scale industry, SMEs, investors, tax professionals, and trade associations has come together to write the following open letter, respectfully requesting your immediate action.

Open Letter to

The Right Honourable Muhammad Shehbaz Sharif

Prime Minister of Pakistan

Subject: Request to Repeal Unconstitutional Clauses in the Finance Bill 2025

Respected Prime Minister,

We write to you with deep concern regarding several provisions introduced in the Finance Bill 2025, which, if enacted in their current form, would significantly undermine constitutional protections, erode business confidence, and deter investment at a critical time in Pakistan’s economic recovery.

The following clauses in particular have raised alarm across the formal business sector, legal community, and civil society:

- Section 37AA: Authorizing arrest without warrant on mere suspicion of tax fraud

- Section 11E: Enabling tax recovery without investigation, based solely on suspicion

- Section 14AE: Permitting seizure of business premises and assets with minimal safeguards

- Section 32B: Empowering private auditors with quasi-legal enforcement powers

- Section 33: Imposing harsh punishments for broadly and vaguely defined “tax fraud”

- Section 37B: Allowing detention for up to 14 days without full judicial scrutiny

- Section 58C: Granting access to tax advisers’ offices, breaching client confidentiality

These provisions appear to contravene key fundamental rights enshrined in the Constitution of Pakistan:

- Article 4: Right to be dealt with in accordance with law

- Article 9: Security of person

- Article 10A: Right to fair trial and due process

- Article 14: Inviolability of human dignity and privacy

- Article 18: Freedom to conduct lawful business or profession

The proposed clauses, particularly those permitting arrest, detention, or seizure without due process, risk being misapplied and may incentivize coercive practices. Their adoption would create an environment of fear and uncertainty among legitimate businesses and professionals. Such measures are incompatible with the government’s stated objectives of facilitating formalization, investment, and economic growth.

Moreover, these provisions are in direct contradiction to your own vision of building a business-friendly Pakistan a vision you have consistently and admirably upheld as essential for economic revival, foreign investment, and job creation. Your leadership has been praised for its commitment to pragmatic reform and investor engagement. It is in this spirit that we appeal to you to ensure that these regressive measures are repealed.

The Honourable Courts of Pakistan have repeatedly protected citizens against executive overreach where fundamental rights are at stake. There is significant legal precedent to suggest that these clauses could be declared ultra vires the Constitution if challenged in court.

In light of the above, we respectfully urge you to direct the Ministry of Finance and the FBR to remove these provisions before the Finance Bill is passed into law. Tax enforcement must be based on legal process, judicial oversight, and accountability not unchecked power or fear.

We believe this moment calls for bold but balanced governance. We trust your administration will act in the best interest of both the state and its citizens by ensuring that reforms support not undermine the rule of law and Pakistan’s economic future.

Sincerely,

The Business Community of Pakistan

This letter has been written because the new powers proposed in the Finance Bill 2025 have sparked alarm across every level of Pakistan’s formal economy. The clause that allows the FBR to arrest any CEO based on mere suspicion of tax fraud without a warrant or judicial review is particularly dangerous. In a country where abuse of power has real consequences, such laws can be used not for justice, but for coercion. The letter draws attention to real risks: investors withdrawing capital, entrepreneurs hesitating to expand, and businesses reconsidering Pakistan as a destination for growth.

Such provisions threaten to undo all progress made by institutions like the Strategic Investment Facilitation Council (SIFC) in restoring investor confidence and global credibility. While one part of the government is working to build Pakistan’s economic future, another is undermining it through authoritarian measures.

Tax enforcement is necessary. But fear-based governance is not the way forward. This letter is a call to preserve the Constitution, protect honest businesses, and ensure Pakistan remains a place where economic growth and the rule of law go hand in hand.

Comments (0)

No comments yet. Be the first to comment!

Leave a Comment