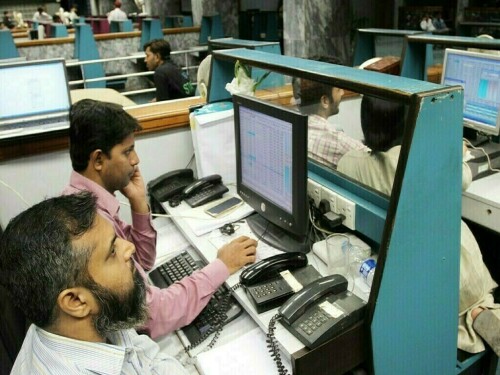

Market Update: Profit-Taking Follows Initial Surge on KSE-100

Following an initial surge that propelled the KSE-100 Index past the 120,000 mark, profit-taking activity was seen during Tuesday’s intraday trading session.

The stock market commenced trading with considerable optimism, as the KSE-100 experienced a surge of approximately 2,800 points, attaining an intraday peak of 120,067.12.

However, this upward drive proved transient as investors opted to secure profits, according to market analysts.

As of 11:50 am, the benchmark index was recorded at 117,426.88, reflecting an increase of 129.15 points, equivalent to a 0.11% gain.

In a significant development, Finance Minister Muhammad Aurangzeb stated in a recent interview that the forthcoming fiscal year’s federal budget, set to commence in July, is anticipated to be finalized within the next three to four weeks. He also noted that discussions with the IMF regarding the budget are scheduled from May 14-23.

On the previous day, the stock market demonstrated a notable resurgence, spurred by a combination of encouraging factors, including the IMF’s approval of essential funding.

The KSE-100 Index witnessed a substantial gain of 10,123 points, marking its most significant single-day increase, ultimately settling at 117,297.73.

Meanwhile, Indian benchmark indexes initiated trading on a weaker note on Tuesday, following their strongest session in over four years, which was prompted by a fragile ceasefire.

India’s Nifty 50 declined by 0.52% to 24,784.95, and the BSE Sensex decreased by 0.64% to 81,900.2 as of 9:25 am IST. At the start of trading, losses were recorded in eight of the thirteen primary sectors. The broader small-cap and mid-cap segments each saw gains of approximately 0.2%.

The Nifty 50 and Sensex indexes rose by nearly 4% in a broad rally, following news of a ceasefire between India, after days of border confrontations.

Market analysts suggest that benchmarks are expected to consolidate following the rally.

Global investor sentiment remains positive following an agreement between the U.S. and China to reduce tariffs and cooperate to avoid damage to the global economy.

MSCI’s Asia ex Japan index showed a gain of 0.3%, after a 2% increase in the previous session, driven by trade optimism.

This information constitutes an intra-day market update.

Comments (0)

No comments yet. Be the first to comment!

Leave a Comment