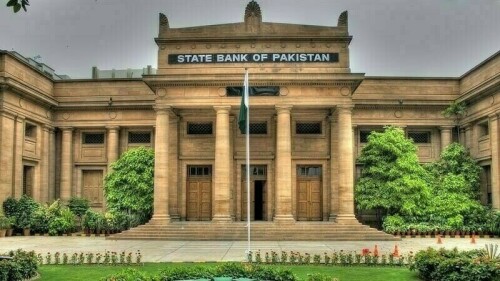

State Bank of Pakistan Expected to Maintain Policy Rate

Market analysts predict that the Monetary Policy Committee (MPC) of the State Bank of Pakistan (SBP) will likely maintain the key policy rate at 11% during its approaching meeting on Monday.

Arif Habib Limited (AHL) stated in their analysis that despite considerable advancements in domestic macroeconomic indicators, notably inflation and the external account, the central bank is expected to remain cautious due to increasing global uncertainties and ongoing domestic policy adjustments.

The central bank announced on Thursday that the MPC will convene on June 16 to determine the policy rate. The SBP will release the Monetary Policy Statement via a press release on the same day.

In its previous session on May 5, 2025, the MPC decreased the policy rate by 100 basis points (bps) to 11%.

This rate marked the lowest since March 2022 (9.75%). Since June, the central bank has reduced the rate by a total of 1,100bps from a peak of 22%.

During that meeting, the MPC observed a significant decline in inflation throughout March and April, primarily attributed to lower administered electricity prices and a consistent decrease in food inflation.

AHL’s report, issued on Friday, suggested that while domestic conditions favor an easing approach, recent geopolitical events have increased potential risks.

Rising tensions in major oil-producing regions have led to a sharp increase in global oil prices. Benchmark crude contracts, including Brent, WTI, and Arab Light, have risen by approximately 10-12% week-on-week, with daily increases exceeding 6% in recent readings.

AHL noted that this situation presents both direct and indirect inflationary challenges for Pakistan, an economy that relies heavily on oil imports.

The brokerage house estimates that each USD 5/bbl increase in global oil prices annually adds roughly 23bps to headline inflation.

Additionally, any required upward revisions in domestic energy tariffs, while necessary to address circular debt, would also contribute to inflationary pressures. The timing and extent of these adjustments, alongside variations in food prices and potential disruptions to global trade, could significantly alter the inflation forecast.

Topline Securities also anticipates the maintenance of the status quo, noting that international crude oil prices have rebounded to US$68-70 per barrel amidst growing tensions in the Middle East and an anticipated US-China agreement.

Topline stated that a cautious strategy is warranted from policymakers, as fluctuations in oil prices have historically been a key factor influencing inflation.

The brokerage house also mentioned that significant notifications, such as gas and electricity price adjustments, are expected before the start of the next fiscal year.

Topline reported that their survey indicated 56% of market participants expect the monetary policy to remain unchanged in the upcoming meeting, compared to 31% in the previous survey. Conversely, 44% anticipate a rate cut of at least 50bps.

Of those expecting a rate cut, 19% foresee a 50bps reduction, while 25% predict a 100bps reduction.

Comments (0)

No comments yet. Be the first to comment!

Leave a Comment